How Mortgages Vancouver can Save You Time, Stress, and Money.

Table of ContentsLoans Vancouver Things To Know Before You Get ThisThe Buzz on Home Equity Loans BcA Biased View of Second Mortgage VancouverWhat Does Mortgages Vancouver Do?

The consumer makes normal, fixed settlements covering both primary as well as rate of interest. As with any type of mortgage, if the car loan is not paid off, the house can be offered to satisfy the remaining financial obligation. A home equity car loan can be a great method to convert the equity you have actually accumulated in your home into cash money, specifically if you invest that cash in home renovations that raise the value of your home.

Ought to you wish to move, you might end up losing cash on the sale of the home or be not able to relocate. And if you're getting the loan to repay bank card financial obligation, withstand the lure to run up those charge card expenses once more. Prior to doing something that puts your house at risk, evaluate all of your choices.

The Tax Obligation Cuts as well as Jobs Act of 2017 put on hold the reduction for passion paid on residence equity car loans as well as HELOCs till 2026, unless, according to the internal revenue service, "they are utilized to buy, build, or considerably improve the taxpayer's house that secures the lending." The rate of interest on a home equity funding utilized to consolidate debts or pay for a child's college costs, for instance, is not tax obligation deductible.

When looking, think about a financing with your regional cooperative credit union as opposed to focusing just on big banks, suggests Clair Jones, a real estate and moving expert who composes for and also i, MOVE.com. "Lending institution often provide better rate of interest prices and even more individualized account service if you want to manage a slower application handling time," Jones says.

Mortgages Vancouver Fundamentals Explained

"You need to have a common sense of where your credit scores and house worth are prior to using, in order to save cash," says Casey Fleming, branch supervisor at Fairway Independent Home loan Corp. and also writer of "The Loan Overview: Just How to Obtain the most effective Feasible Home Loan." "Particularly on the evaluation [of your house], which is a significant cost.

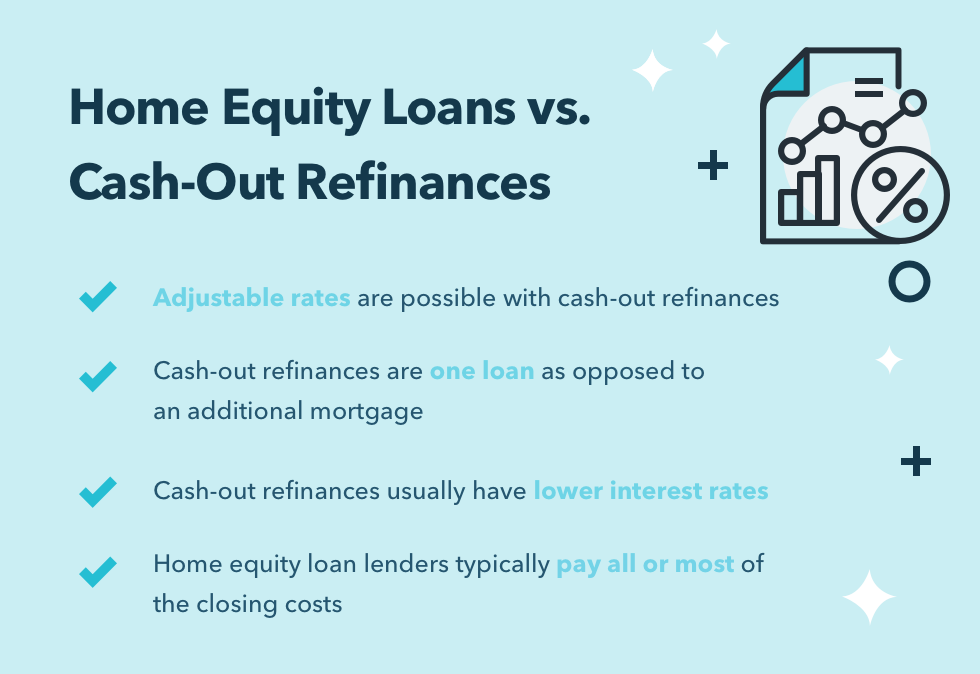

Residence Equity Loans vs. HELOCs House equity car loans offer a solitary lump-sum settlement to the customer, which is settled over a set period of time (generally five to 15 years) at an agreed-upon rate of interest. The payment and also rate of interest price stay the same over the lifetime of the lending. The car loan needs to be paid off in full if the residence on which it is based is offered.

The draw duration (5 to ten years) is followed by a settlement period when draws are no longer enabled (10 to twenty years). HELOCs normally have a variable interest rate, but some lending institutions offer HELOC fixed-rate options. Benefits and Drawbacks of a Home Equity Car Loan There are a number of essential advantages to residence equity financings, consisting of price, yet there are also disadvantages.

Foreclosure Loans Things To Know Before You Get This

If you have a consistent, reliable resource of revenue and also understand that you will have the ability to repay the lending, low-interest rates and feasible tax reductions make house equity financings a practical selection. Getting a residence equity loan is fairly simple for many customers due to the fact that it is a safe financial obligation.

The passion rate on explanation a home equity loanalthough greater than that of an initial mortgageis a lot lower than that of charge card and also other redirected here customer finances. That assists explain why a main factor consumers obtain versus the worth of their homes via a fixed-rate home equity finance is to settle bank card balances.

Understand that the rate of interest paid on the part of the finance that is over the worth of the house is never tax insurance deductible. When obtaining a residence equity financing, there can be some lure to borrow greater than you promptly require since you just obtain the payout as soon as, and also you do not know if you'll get one more lending in the future.

The 4-Minute Rule for Home Equity Loan Vancouver

Were you incapable to live within your ways when you owed only 100% of the equity in your home? If so, it will likely be unrealistic to anticipate that you'll be much better off when you boost your financial obligation by 25%, plus rate of interest as well as fees. This could become a domino effect to bankruptcy as well as foreclosure.

Consolidating that debt to a home equity finance at a rate of 4% with a term of 5 years would really cost you even more cash if you took all 5 years to pay off the house equity lending. Bear in mind that your home is currently collateral for the funding instead of your cars and truck.

Price quote your home's existing worth by comparing it to current sales in your location or utilizing an estimate from a website like Zillow or Redfin. Realize that their worth estimates are not always accurate, so adjust your estimate as needed thinking about the existing condition of your home. Separate the present balance of all car loans on your residential property by your existing property worth quote to get visit this website your current equity percent in your house.